Global markets weekly update

23.04.2024

U.S.

- Major indices posted weekly declines for the third consecutive week amid heightened tensions in the Middle East and worries of U.S. interest rates remaining “higher for longer”. Mega-cap technology stocks suffered the most as rising rates placed a. higher theoretical discount on future earnings. The S&P 500 ended the week down 3%. The Nasdaq weekly decline was steeper at about 5.5%; in contrast, the Dow Jones posted a little gain.

- The price of U.S crude oil climbed 4% to more than USD 85 per barrel late Thursday in the wake of the latest hostilities between Israel and Iran. Prices rapidly eased to USD 83 per barrel as tensions somewhat deescalated.

- Strong economic data seemed to increase worries that the Fed would push back any interest rate cuts to the fall if not to 2025. Retail sales rose 0.7% in March, well above consensus expectations of 0.3%, while February’s gains were revised upward to 0.9%. Higher gas prices were partly responsible, but the gains were broad-based and encompassed gains in discretionary categories, such as restaurants, bars, and online retailers.

- Housing starts and permits in March came in well below expectations. Existing home sales also declined, although largely in line with expectations, as the average 30-year mortgage rate climbed above 7% for the first time since December. These downwardsurprises in housing market data further fueled inflation fears amid prolonged supply tightness.

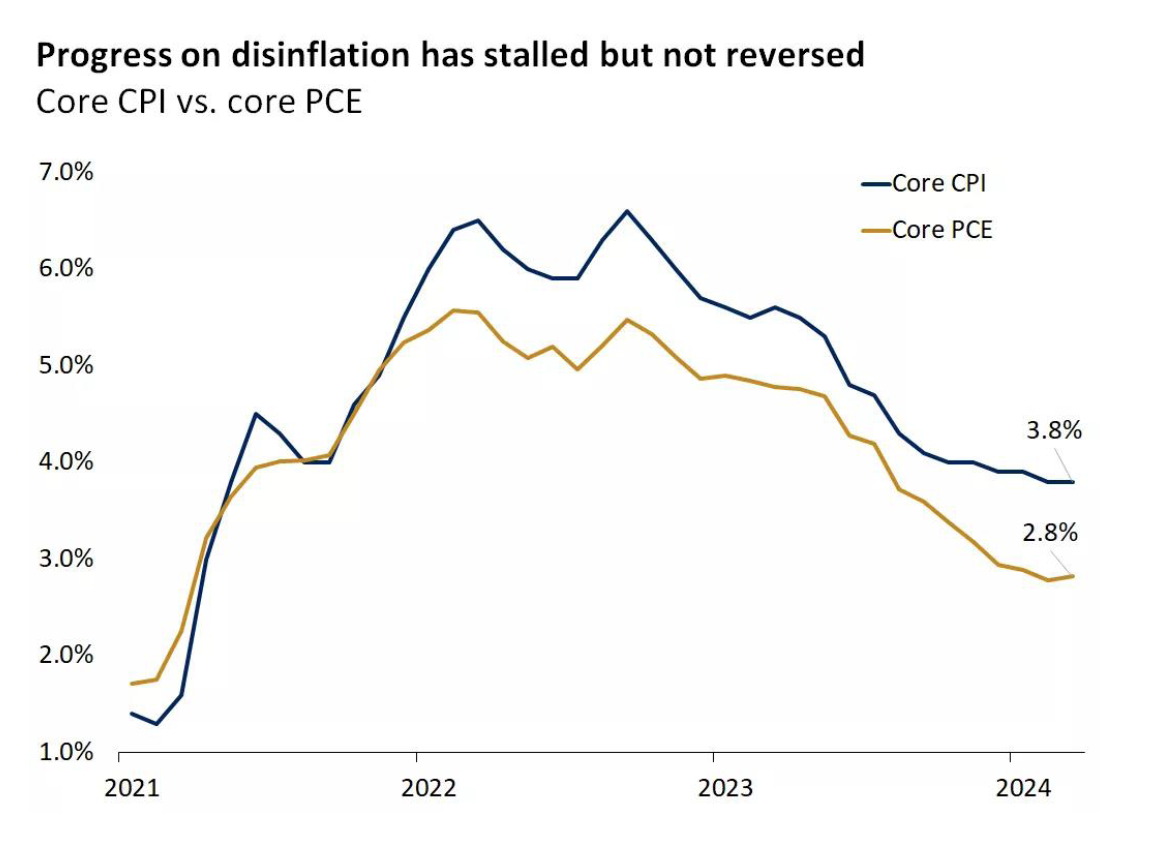

- As was the case the previous week, Fed officials expressed their concern with recent economic data. On Tuesday, Fed Chair Jerome Powell stated at an economic conference that “recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.” On Thursday, New York Fed President John Williams warned that a rate hike is not the baseline, but that one is possible if the data warrants. Atlanta Fed President Raphael Bostic said that policymakers would not be able to cut rates until the end of the year. The market has repriced Fed rate cuts and is now expecting just one rate cut in 2024, a sizable shift from the six rate cuts expected at the beginning of the year. The yield of the 10-year U.S. Treasury bond briefly rose as high as 4.69% on Tuesday—the highest since last November—before retreating somewhat to close at 4.61% on Friday.

Europe

- The Eurostoxx 600 ended the week 1.18% lower amid heightened tensions in the Middle East. Germany’s DAX fell 1.08%, Italy’s FTSE MIB gained 0.47%, and France’s CAC 40 Index was little changed. The FTSE 100 Index declined 1.25%.

- UK inflation grew at an annual 3.2% in March, down from 3.4% in February. The decline was marginally less than forecast by analysts and the Bank of England due to elevated price growth in oil and communication goods. Wage growth also slowed less than expected in the three months through February. The unemployment rate rose sharply to 4.2% in February from 3.9%. Higher oil prices and the rather sticky inflation data prompted markets to push out expectations for a first cut in UK interest rates from June to sometime in the fall.

- On the contrary, ECB policymakers are still sticking with a June rate cut, barring unexpected economic shocks. ECB President Christine Lagarde declined to say whether there might be more than one reduction in rates. She warned that the ECB would monitor oil prices “very closely” amid worries about conflict in the Middle East. For the time being, markets are pricing three to four rate cuts this year.

Japan

- Japanese stocks finished the week considerably lower amid the tensions in the Middle East. The Nikkei 225 was down 6.2% and the broader TOPIX Index lost 4.8%. The yen, perceived as a safe-haven currency especially in times of geopolitical turmoil, strengthened on the final trading day of the week. It nevertheless remains around the 34-year low, ending the period at JPY 154 against the USD, further fueling speculation that the BoJ would intervene in the foreign exchange market to support the currency. However, for the time being, the BoJ ruled out responding to the yen weakness with a rate hike.

- Japan’s exports rose 7.3% year on year in March (slightly slower than the 7.8% gain recorded in February). The data nonetheless marked the fourth consecutive month of growth in exports, attributable to the tailwind provided to Japan’s exporters by historic yen weakness.

China

- Chinese equities rose during the week as the economy grew more than expected in the first quarter. The Shanghai Composite Index gained 1.52%, while the blue chip CSI 300 added 1.89%.

- China’s GDP expanded an above-consensus 5.3% in the first quarter from a year ago, accelerating slightly from the 5.2% growth in last year’s fourth quarter.

- The release of other data revealed a more ambivalent picture of the economy. Industrial production rose a lower-than-expected 4.5% in March from a year earlier, down from 7% growth in the January to February period. March retail sales grew a lower-than-expected 3.1% from a year ago as catering and auto revenue slowed after the Lunar New Year Holiday. Fixed asset investment rose more than anticipated in the first quarter from a year ago, although property investment fell 9.5% year on year. The urban unemployment rate improved slightly to 5.2%, while the youth jobless rate stayed at 15.3% in March, unchanged from February.

Portfolio considerations

Fixed Income

We maintain our overweight in fixed income, as the asset class is supported by a combination of historically attractive yields and the prospect of rate cuts. The latest inflation data complicates the Fed plans to cut rates but doesn’t eliminate the broader outlook for loosening policy later this year. Our view is that the markets were far too optimistic about the timing and the magnitude of rate cuts this year. While the markets are impatient for the first rate cut, it’s far more prudent for the Fed to take its time and ensure inflation is headed sustainably lower. We still believe that it is time to lock-in today’s historically high yields (even more so after last weeks’ interest rates rise) by increasing duration. This holds true for buy-and-hold investors as well as for those seeking absolute returns. The belly of the curve (5-6y) offers the best risk-adjusted return as it allows investors to limit reinvestment risk and to benefit from future rate cuts, while not taking excessive duration risk.

Equities

Stocks have pulled back in recent weeks. Although unpleasant, we believe this temporary weakness was expected given the strength of the recent rally (25% +) and the adjustments to policy expectations. In our view, the key question is whether the recent pullback could turn into a deep and lingering bear-market. We don’t see this as a high-probability outcome, given the resilience of the U.S. economy, supported by strong consumer demand and a robust labor market. In addition, bear markets also tend to occur when the Fed is hiking rates. We believe the Fed will be patient but will likely still consider a rate cut as its next move. Pullbacks could prove to be an opportunity to diversify into segments of the market that have lagged, rebalance, and add quality names to the portfolio.

Global Markets weekly update

please download our PDF file here : Download now