Global markets weekly update

15.04.2024

U.S.

- Major indices posted weekly declines for the second week in a row amid heightened tensions in the Middle East and signs of stubborn inflation pressures that pushed long-term Treasury yields as high as 4.59% (considering that on February 1, the 10-year yield had closed as low as 3.86%).

- Reports of possible imminent Iranian strike on Israel sent investors flocking to oil and U.S. dollar, typically viewed as a “safe haven” in times of turmoil. Gold prices rose for a third consecutive week, adding to the record highs reached in the previous weeks. On Friday, gold futures climbed as high as USD 2’448, up 1% for the week and more than 9% since March 22. Meanwhile, the VIX spiked to its highest level since November.

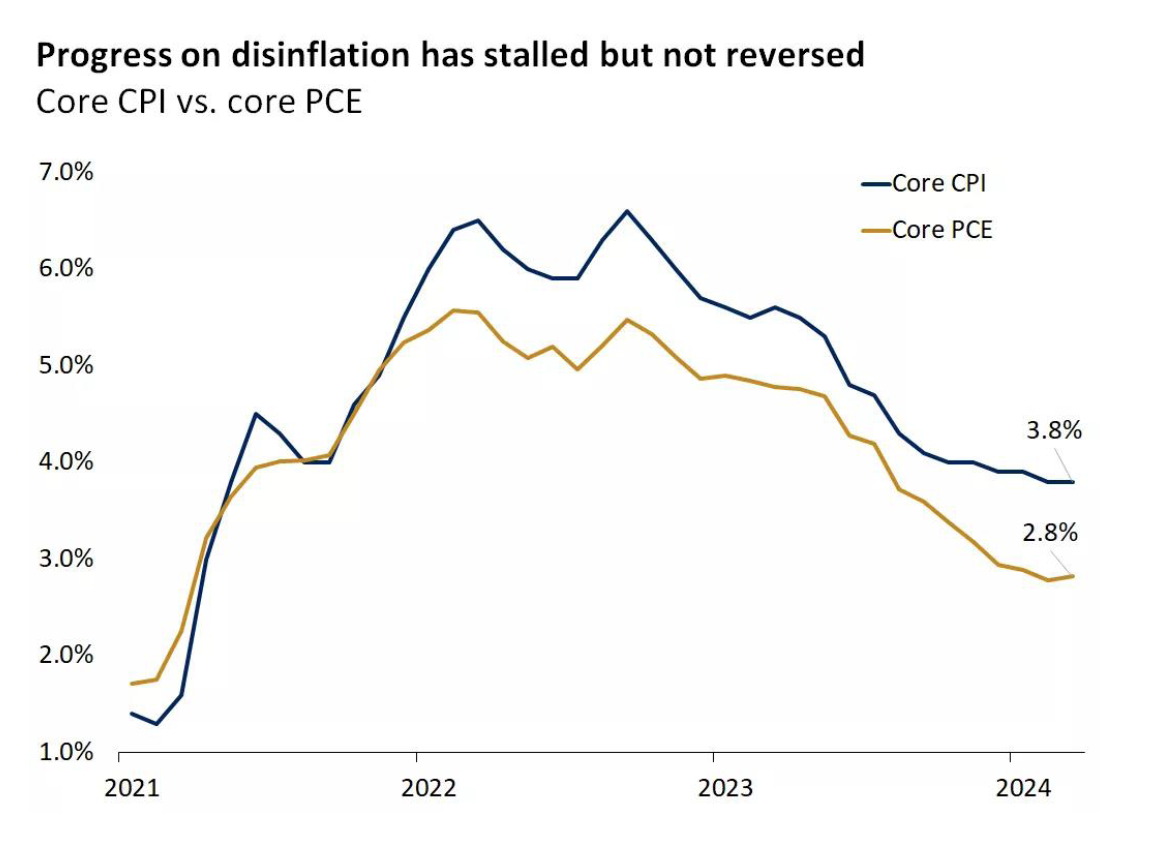

- The primary factor weighing on investors’ sentiment was undoubtedly the release on Wednesday of the Consumer Price Index data, which showed headline prices rising at an annual rate of 3.5% in March, up from 3.2% the previous month. Excluding volatile food and energy prices, core inflation rose 3.8%. This hotter-than-expected inflation data reversed rate cut bets and increased market expectations that the Fed might deliver as few as one rate cut this year, as it waits for confirmation that inflation is under control. That compares with the six or more cuts expected back in January and the three that the more conservative Fed had projected. These figures do not call into question the disinflation scenario, but the rate at which inflation is falling.

Europe

- The Eurostoxx 600 ended the week 0.26% lower. Germany’s DAX lost 1.35%, France’s CAC 40 Index declined 0.63%, and Italy’s FTSE MIB slid 0.73%. However, the UK’s FTSE 100 Index gained 1.07%.

- On Thursday, the ECB left its key deposit rate unchanged at a record high of 4%, as expected, but signaled it was still on course to deliver rate cuts in June. If an updated inflation assessment, which is due in June, “were to increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” However, the rethink on US rates has also spilled over to Europe, with investors now pricing in three cuts for the ECB and two for the BoE in 2024, down from more than six each at the start of the year. Pressure on the euro increased because of growing expectations that eurozone interest rates would fall ahead of those in the U.S.

- UK GDP for February expanded 0.1% sequentially, due to a rebound in manufacturing output. The Office of National Statistics also revised January GDP growth 0.3% from 0.2%, suggesting the economy exited recession.

Japan

- Japanese stocks gained over the week with the Nikkei 225 up 1.4% and the broader TOPIX Index rising 2.1%.

- The Japanese Yen reached a 34-year low at JPY 152 against the USD, further fueling speculation that the BoJ would intervene in the foreign exchange market to support the currency. However, for the time being, the BoJ ruled out responding to the yen weakness with a rate hike.

- Last month, the Bank of Japan ended negative interest rates and its cap on 10-year government bond yields. Market participants are pricing in two more rate hikes within the space of a 12-month period. Nevertheless, Japan’s monetary policy remains among the most accommodative in the world, and financial conditions are expected to remain accommodative as well for the time being.

China

- Chinese equities retreated during the week as weak inflation data confirmed the lackluster demand hanging over the Chinese economy.

- China’s CPI rose a below-consensus 0.1% in March from a year earlier, down from February’s 0.7% rise, as food costs retreated. Core inflation rose by 0.6% but was weaker than February’s 1.2% increase. Meanwhile, the producer price index fell 2.8% from a year ago, marking its 18th month of declines.

- China’s March exports dropped by 7.5%, and imports unexpectedly contracted by 1.9%, missing market expectations. the worse-than-expected momentum of both exports and imports in March indicate that more comprehensive and targeted policy stimulus will be needed for China to meet its ambitious growth target set at 5%.

Portfolio considerations

Fixed Income

We maintain our overweight in fixed income, as the asset class is supported by a combination of historically attractive yields and the prospect of rate cuts. The latest inflation data complicates the Fed plans to cut rates but doesn’t eliminate the broader outlook for loosening policy later this year. Our view is that the markets were far too optimistic about the timing and the magnitude of rate cuts this year. While the markets are impatient for the first rate cut, it’s far more prudent for the Fed to take its time and ensure inflation is headed sustainably lower. We still believe that it is time to lock-in today’s historically high yields (even more so after last weeks’ interest rates rise) by increasing duration. This holds true for buy-and-hold investors as well as for those seeking absolute returns. The belly of the curve (5-6y) offers the best risk-adjusted return as it allows investors to limit reinvestment risk and to benefit from future rate cuts in 2024, while not taking excessive duration risk.

Equities

Stocks have pulled back in recent days but remain only slightly below all-time highs. The S&P 500 is just 2% below its all-time high, which is the largest pullback since October of last year. The stock market has returned 27% during that stretch. Although unpleasant, we believe this temporary weakness is reasonable given the strength of the recent rally and the adjustments to policy expectations. As the markets continue to digest this new Fed backdrop, we suspect some setbacks will continue emerge along the way. They could prove to be an opportunity to diversify into segments of the market that have lagged, rebalance, and add quality names to the portfolio. And at the end of the day, a stronger economy with a little inflation isn’t such a bad backdrop if we consider the favorable outlook for corporate earnings growth.

Global Markets weekly update

please download our PDF file here : Download now