Global markets weekly update

17.11.2025

U.S.

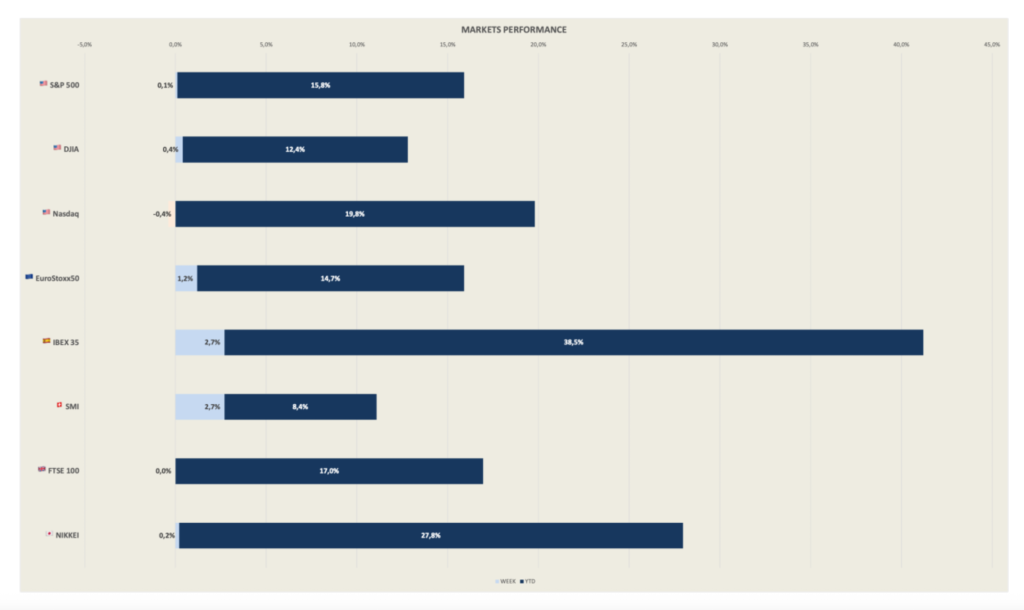

- U.S. stock indexes stabilized at the end of the week, recovering from a sharp drop, as concerns about highly valued tech companies, high concentration, and the path of interest rates battered the market. The S&P 500 and the Dow Jones finished fractionally higher for the week, while the Nasdaq ended slightly lower.

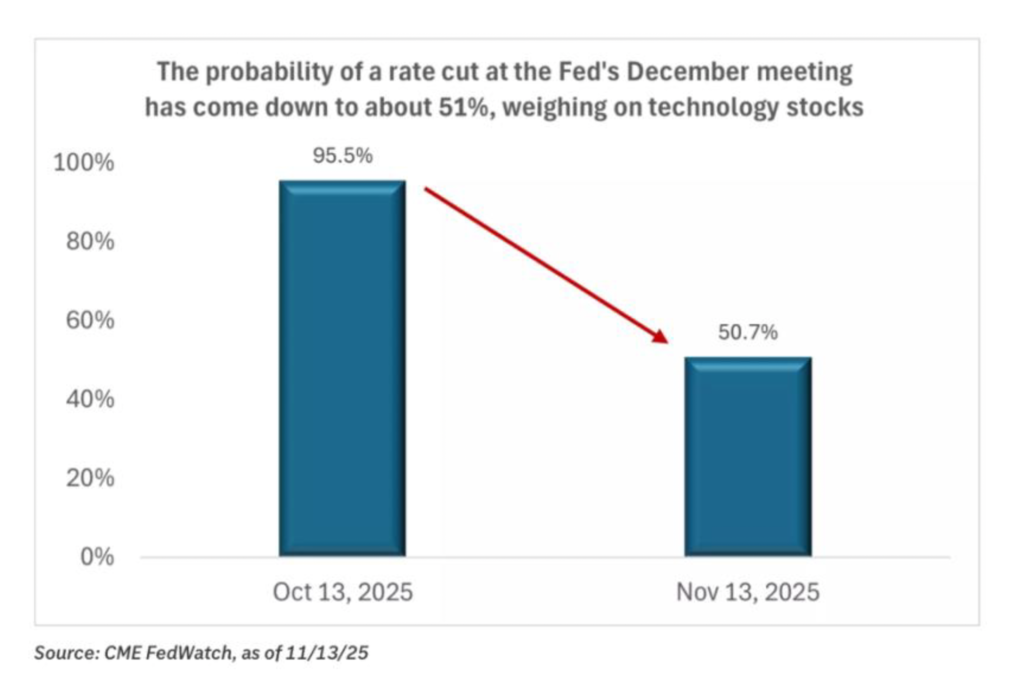

- Bond market traders scaled back their expectations of an interest rate cut at the Fed meeting on December 10. Prices in rate futures markets implied a nearly 50% probability that the Fed would cut by 25bps, according to CME FedWatch. Just a week earlier, traders had been pricing in a nearly 95% probability of a December cut. Speaking Wednesday, Atlanta Fed President Raphael Bostic stated that he considers “signals from the labor market as ambiguous and difficult to interpret” and believes that they are “not clear enough to warrant an aggressive monetary policy response when weighed against the more straightforward risk of ongoing inflationary pressures.” Meanwhile, St. Louis Fed President said he believes policymakers “need to proceed and tread with caution.”

- With earnings season nearly complete as of Friday, overall results remained well above analysts’ expectations. S&P 500 companies’ earnings were expected to rise by an average of 13.1% versus a forecast for about 8.0% growth entering earnings season, according to FactSet.

- Despite the end of the government shutdown, it remains unsure when many key reports will be released, how complete they will be, and whether some releases may be canceled. The September jobs report is set to be released on Thursday, November 20.

- Diminished prospects for an interest rate cut by the Fed at its December meeting weighed on government bond prices, sending the yield of the 10-year U.S. Treasury higher. The yield finished on Friday at 4.15%, up from about 4.09% at the close of the previous week. Yields of 2- and 30-year Treasuries were also higher for the week.

Europe.

- The Eurostoxx 600 ended the week 1.77% higher, relieved by the reopening of the U.S. federal government. However, cooling sentiment on artificial intelligence limited the market’s gains. Most major stock indexes rose. Germany’s DAX climbed 1.30%, France’s CAC 40 Index advanced 2.77%, and Italy’s FTSE MIB was up 2.51%. The UK’s FTSE 100 Index was little changed.

- The UK labor market is experiencing a cooling trend. The rate of UK unemployment has risen to 5% in the three months to September, up from 4.8% in the three months to August and the highest level in four years. Wage growth also slowed in the third quarter. GDP growth slowed more than forecast to 0.1% in the third quarter—below a consensus estimate of 0.2% forecast. GDP contracted in September by 0.1% sequentially. The slowdown was partly due to a 28.6% decline in car production in September, driven by a shutdown at Jaguar Land Rover after it suffered a cyberattack.

- fter dropping 1.1% in August, eurozone industrial production in September ticked up 0.2% versus the prior month—well below the 0.9% forecast in a FactSet market survey.

- Investor sentiment fell unexpectedly in Germany, according to the ZEW economic research institute.

Japan

- Japan’s stock markets advanced over the week, with the Nikkei 225 Index up 0.20% and the broader TOPIX Index climbing 1.85%. Conversely, continued concerns about lofty valuations of companies linked to artificial intelligence weighed on Japan’s technology sector.

- Expectations of policy changes under Japan’s new prime minister, Sanae Takaichi, with her administration in favor of a loose fiscal policy and cautious interest rates hikes, pressured the yen. The Yen weakened to JPY 154.6 against the USD. Takaichi recently sought to allow for more flexible spending by reconsidering the government’s current single-year fiscal discipline target and announcing plans to set a new fiscal target extending through several years. She favors a responsible, yet aggressive, fiscal spending to boost economic growth. Investors now converge around the view that a January rate hike now looks more likely.

China

- Chinese equities retreated over the week as investors preferred to lock in the gains after the leading domestic benchmark rose to its highest level in almost four years. The onshore blue chip CSI 300 was down 1.26% and the Shanghai Composite Index shed 0.18%.

- The latest batch of official indicators showed that China’s economy lost steam as it entered the fourth quarter. Fixed asset investment shrank 1.7% in the first 10 months of the year, a record drop for the period, according to China’s statistics bureau. Industrial production rose a weaker-than-expected 4.9% in October from a year ago, while retail sales rose 2.9%, the fifth straight month of slower growth.

- Other data showed that China’s housing market, now in its fourth year of a slump, remained under pressure. New home prices in 70 cities fell 0.45% in October from September, the steepest decline in a year, while existing home values fell 0.66%, the biggest drop in 13 months, Bloomberg reported. The perduring fragility in China’s property market has been a major growth obstacle, making consumers hesitant to spend.

Portfolio considerations

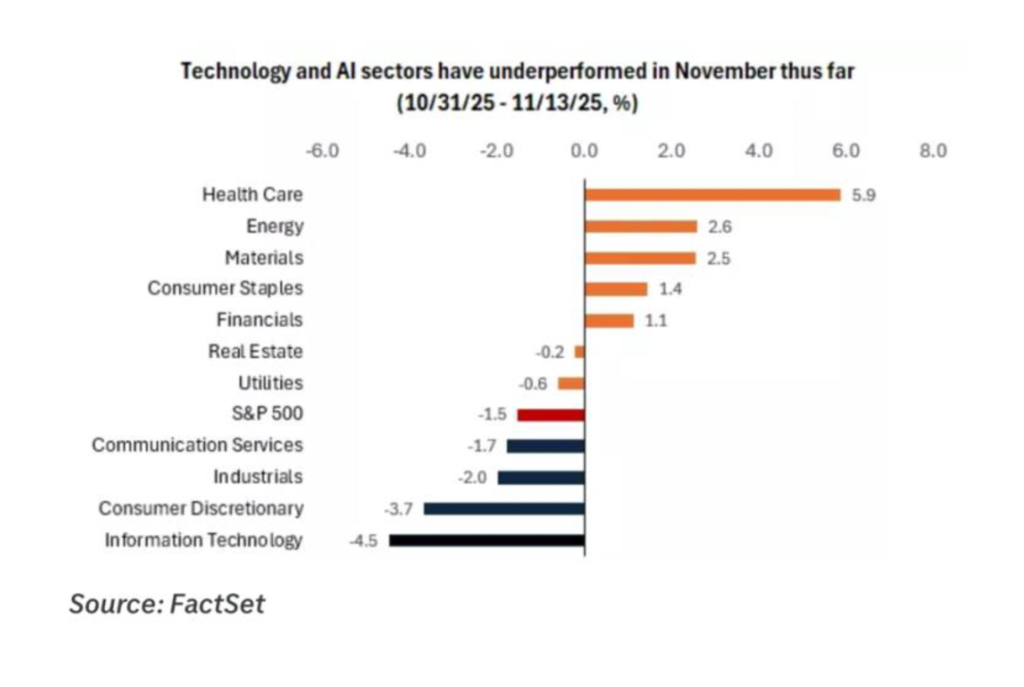

Equities

Recent volatility highlights the risks of historic market concentration, with the top 10 stocks now representing over 40% of the S&P 500’s market cap. Bubble concerns are rising. Technology and AI sectors are underperforming in November after a strong rally since April. We believe investors should maintain exposure to AI-related stocks, a durable theme, but avoid overconcentration. Diversification remains key in this backdrop, and we see opportunities in underrepresented areas with catch-up potential, such as the health care sectors and emerging market equities, to balance technology exposure.

Fixed Income

We continue to advocate seizing the yield advantage in high quality fixed income to build resilient portfolios, especially since equity valuations remain stretched. We recommend overweighting intermediate-maturity bonds (5-7 years) and avoiding long-term sovereign bonds more exposed to concerns over widening government budget deficits and rising debt levels.