Global markets weekly update

23.06.2025

U.S.

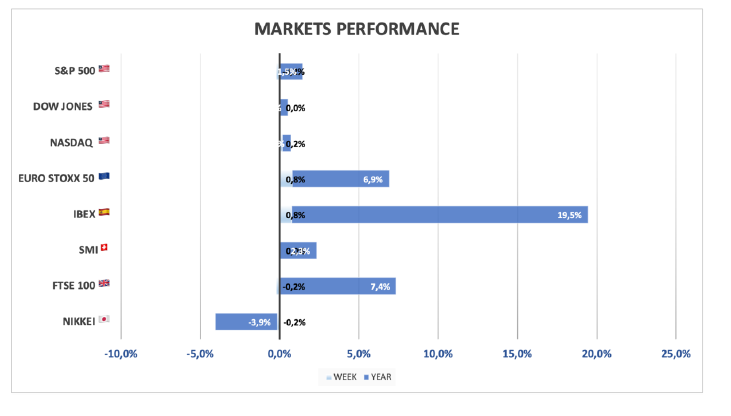

- Stocks closed mixed against a backdrop of high geopolitical uncertainty. Smaller-cap indexes performed best for the week, followed by the Nasdaq Composite, which posted modest gains. The Dow Jones Industrial Average was flat, while the S&P 500 Index finished slightly lower (-0.2%). U.S. markets were closed on Thursday in observance of the Juneteenth holiday.

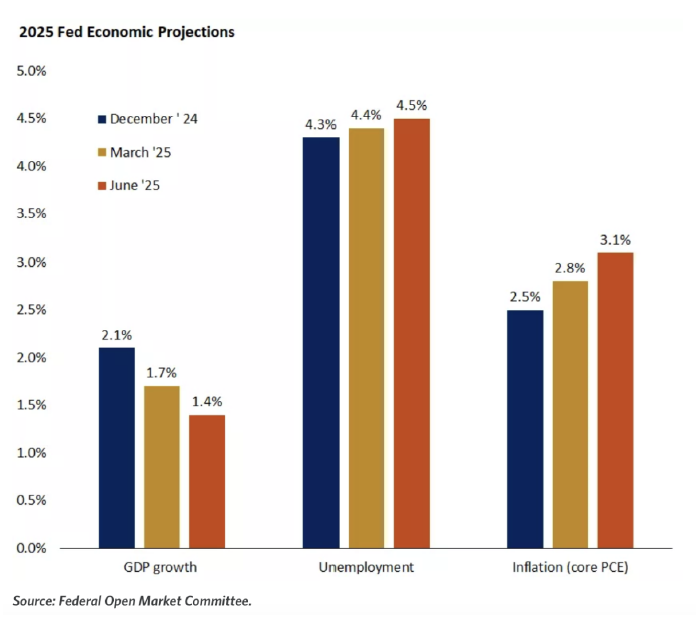

- Following its June monetary policy meeting on Wednesday, the Fed announced that it would keep the target range for the federal funds rate steady at the level of 4.25% to 4.5%, as was widely expected. This is the fourth consecutive meeting at which the Fed has decided to leave its policy rate range unchanged. Speaking at a press conference after the meeting, Jerome Powell noted that “despite elevated uncertainty, the economy is in a solid position,” and the Fed remains “well positioned to respond in a timely way to potential economic developments.” The Fed’s Summary of Economic Projections, also released Wednesday, showed that policymakers expect to make two interest rate cuts through the remainder of the year (unchanged from their previous projection). However, expectations for inflation and unemployment by the end of 2025 both rose, while projections for GDP growth declined.

- In a Friday morning interview, Fed Governor Christopher Waller made comments suggesting the central bank could potentially cut rates as soon as July, appeared to provide some support for stocks early in the day.

- Other economic data releases disappointed, starting with the report of retail sales data for May. Tuesday’s report showed that retail sales fell for a second consecutive month, declining 0.9% after April’s drop of 0.1%. The decline was partially attributed to a steep decline in auto sales, which surged in March ahead of the Trump administration’s implementation of a 25% tariff on automobiles.

- Elsewhere, the National Association of Home Builders (NAHB) reported that its Housing Market Index reading was 32 in June, the lowest reading since December 2022. This entails that a majority of builders have a negative current and near-term outlook for the housing market.

- Meanwhile, a separate report from the Census Bureau and the Department of Housing and Urban Development showed that construction of new homes fell 9.8%, reaching the lowest level since May 2020.

Europe.

- The Eurostoxx 600 ended the week 1.54% lower amid heightened tensions in the Middle East. Major stock indexes also fell. Italy’s FTSE MIB slipped 0.53%, Germany’s DAX declined 0.70%, and France’s CAC 40 Index lost 1.24%. The UK’s FTSE 100 Index lost 0.86%.

- The Bank of England (BoE) held interest rates steady at 4.25% as expected, citing elevated global uncertainty and persistent inflation pressures. Policymakers were split 6-3 over the decision. BoE Governor Andrew Bailey said, “interest rates remain on a gradual downward path,” although the central bank said it would take a “gradual and careful” approach to further rate cuts.

- Consumer prices in the UK rose by 3.4% annually in May, down from 3.5% in April. Services price inflation, closely followed by the BoE, slowed to 4.7% from 5.4% in April, in line with the central bank’s forecast.

- The Swiss National Bank reduced its policy rate by a quarter of a percentage point to 0% faced with lower inflation pressure and a strong Swiss franc. It said it was ready to intervene in currency markets if necessary.

- German investor morale rose more than expected in June, according to the ZEW research institute. Its economic sentiment index climbed to 47.5 points from 25.2 points in May. This increase comes after the government ratified a huge tax relief package earlier this month.

Japan

- Despite geopolitical tensions and renewed trade-related concerns, Japan’s stock market ended the week higher, with the Nikkei 225 Index gaining 1.50% and the broader TOPIX Index up 0.54%. The focus was on the Bank of Japan’s June 16–17 monetary policy meeting.

- The BoJ left its policy rate unchanged at 0.5% at the meeting, as expected, and signaled that it would slow the pace at which it reduces its purchases of Japanese government bonds. This decision indicates that the BoJ is concerned about disrupting markets after JGB yields rose sharply in late May partly on concerns that the BoJ may be tapering its purchases too aggressively. Some participants still believe that the BoJ will hike interest rates once more this year. The yield on the 10-year JGB rose to 1.42% from 1.40% at the end of the previous week.

- On the international trade front, the U.S. and Japan failed to reach an agreement on tariffs at the Group of 7 summit, confounding some expectations. The U.S. is set to return its reciprocal tariffs to their higher levels on July 9, which would increase the levies on Japanese imports to 24% from 10%.

- In other economic news, Japan’s core consumer price index rose 3.7% year-on-year in May, ahead of a consensus forecast of 3.6% and April’s 3.5% increase. The major driver of the increase was the surging price of rice.

China

- Chinese equities declined over the week amid the release of a batch of mixed data. The Shanghai Composite Index declined 0.45% and the onshore blue chip CSI 300 retreated 0.51%.

- Retail sales rose 6.4% in May from a year ago, the fastest pace since December 2023, according to the country’s statistics office.

- However, industrial output in May and fixed-asset investment year-to-date both increased less than economists’ forecasts.

- Earlier in the week, a report stressed the persistent weakness in China’s property market. New home prices in 70 cities fell 0.22% in May from April, the biggest month-on-month drop in seven months, while used home prices fell 0.5%, the steepest decline in eight months.

Portfolio considerations

Equities

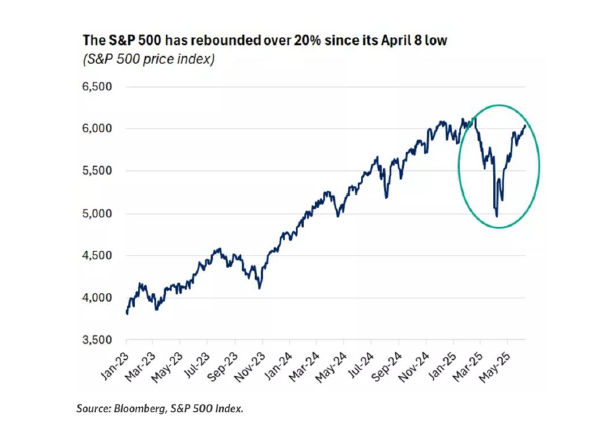

- For investors already grappling with policy uncertainty, elevated tensions in the Middle East add an extra layer of complexity. And after a 20% rally from the April 8 lows, equity markets may face bouts of volatility in the near term. In a time of increased uncertainty, one must remember to stay on track. Diversification across stocks, bonds and alternatives can help investors stay invested, and better help portfolios weather headwinds that may lie ahead.

Fixed Income

Despite worries about government debt and Fed policy, bond yields have stayed rangebound. As rates likely remain higher for longer, bonds will continue to offer attractive income and may still partially help offset equity volatility. However, long-term rates may not fall as quickly as short-term rates, even when the Fed cuts rates again. We therefore recommend overweighting intermediate-maturity bonds.